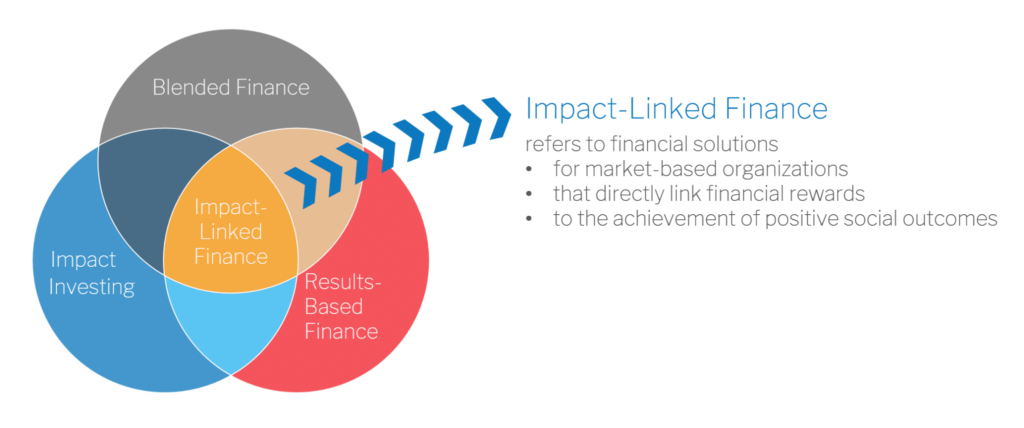

In the past few weeks, I came across several exciting new trends and innovations in the area of impact investment and blended finance. These include; the emerging social impact markets, trading social outcomes, and Impact-Linked Finance.

Impact-Linked Finance is a form of funding that directly links financial rewards to the achievement of positive outcomes. It incorporates financial incentives for enterprises that achieve exceptional (agreed upon and verifiable) positive outcomes. That means that a social enterprise will enjoy better financing terms (ie lower interest rates or a grant alongside a loan) if they meet specific impact outcomes.

“These outcomes can come in many shapes and forms – for example increased incomes for the poor, more gender equality, reduced plastic waste, or improved learning outcomes for children. The more social or environmental value a company creates, the lower its cost of capital will be. This value-creation could have a powerful effect. The best companies in the world – in terms of positive impact – would suddenly be able to raise large amounts of low-cost capital to scale. And even more importantly, they could further optimize their impact. As a result, resources would flow to what matters most to society, and this has mutually reinforcing effects” (Bjoern Struewer, Roots of Impact)

To learn more ILF and Roots of Impact