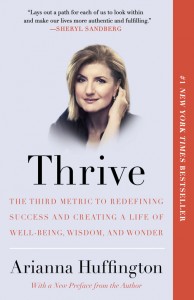

One of the books that I enjoyed reading in 2014 was Arianna Huffington’s “Thrive“. A refreshing book where she makes a compelling case of the need to redefine “what it means to be successful” in today’s world. A timely book in times where people are reassessing their past and current views (on money and power) while trying to define their meaning of life.

SOCAP 2014 : Igniting Vibrant Communities

SOCAP14,which took place on Sept 2-5 in San Francisco brought together over 2500 people (bold entrepreneurs, investors, philanthropists, bankers, as well as government officials) committed or interested to increase social return and impact. The movement continues accelerating: the convergence of the three worlds, private/public/social through new partnerships and collaborations, impact investment and the sharing economy mainstreaming, and the power of social media empowering individuals as well as organizations. There is so much going on and it is great that anyone can see the videos posted on youtube.

Some of my favourite speeches and panels this year include:

1)How is social funding changing the role of financial gatekeepers, for good by Danae Ringelmann, co-founder of Indiegogo.

2)Impact Uncensored, A conversation with Leila Janah, Founder and CEO of Samasource

3)Fast Pitches by Gratitude Awards Finalists

4)Multilingual Leadership=Ignition by Cathy Clarke, Jed Emerson and Ben Thornley. Here multilingual means being able to communicate and be effective across the three sectors: public, private and social.

5)Innovations in Social Finance by Judith Rodin, President of the Rockefeller Foundation

and last but not least….

6)When Life Gives you Lemons, Change the World! by the youngest speaker at SOCAP ever, 10 year old Vivienne Harr, Chief Inspiration Officer of Make a Stand

Swiss Sustainable Finance a new platform promoting sustainability in the Swiss Financial Center

Swiss Financial Finance (SSF) is a new platform that aims to promote Switzerland as the leading centre for sustainable finance. This platform brings together financial service providers, investors, research organizations, public sector entities, and universities to foster social and environmental aspects in investment and financial solutions. SSF was launched at the beginning of July 2014. See the press release.

Swiss Financial Finance (SSF) is a new platform that aims to promote Switzerland as the leading centre for sustainable finance. This platform brings together financial service providers, investors, research organizations, public sector entities, and universities to foster social and environmental aspects in investment and financial solutions. SSF was launched at the beginning of July 2014. See the press release.

The Future of Investing -Towards an 100% impact portfolio

Charly and Lisa Kleissner, pioneers in impact investment and deploying 100% of their assets in impact through their KL Felicitas Foundation, were the keynotes for the event “Inspire to Action- The Future of Investing” hosted by The Impact Hub Zurich on June 16th. Charly and Lisa are one of the most persuasive and effective advocates for impact investing as they “walk the talk” and they SHARE their experiences and findings of their 100% Impact portfolio. For the past 10 years they have been creating a variety of tools to empower and educate both impact enterprises and impact investors. The report Evolution of an Impact Portfolio: From Implementation to Results written by Sonen Capital is a detailed report that you can download from their website that is highly recommended for anyone who would like to learn about investing with impact. Thank you Charly and Lisa!

Charly and Lisa Kleissner, pioneers in impact investment and deploying 100% of their assets in impact through their KL Felicitas Foundation, were the keynotes for the event “Inspire to Action- The Future of Investing” hosted by The Impact Hub Zurich on June 16th. Charly and Lisa are one of the most persuasive and effective advocates for impact investing as they “walk the talk” and they SHARE their experiences and findings of their 100% Impact portfolio. For the past 10 years they have been creating a variety of tools to empower and educate both impact enterprises and impact investors. The report Evolution of an Impact Portfolio: From Implementation to Results written by Sonen Capital is a detailed report that you can download from their website that is highly recommended for anyone who would like to learn about investing with impact. Thank you Charly and Lisa!

Skoll World Forum 2014

The 11th Skoll World Forum on Social Entrepreneurship took place on April 9-11. This year’s theme was Ambition: Fueling Opportunity, Scaling Progress. It is the 8th time that I had the opportunity to attend and it continues to be an amazing forum to learn, connect and share with people that are innovating new ways and creating partnerships to tackle and solve the world’s most pressing problems. This year’s Skoll Awards for Social Entrepreneurship included organizations like B-Lab and Fundación Capital which are helping the convergence of the private sector with the social sector. Also a special Global Treasury award was given to Malala Yousafzai, the 16 year old Pakistan who survived the Taliban attack and has set up the Malala Fund dedicated to helping promote education for girls around the globe.

The 11th Skoll World Forum on Social Entrepreneurship took place on April 9-11. This year’s theme was Ambition: Fueling Opportunity, Scaling Progress. It is the 8th time that I had the opportunity to attend and it continues to be an amazing forum to learn, connect and share with people that are innovating new ways and creating partnerships to tackle and solve the world’s most pressing problems. This year’s Skoll Awards for Social Entrepreneurship included organizations like B-Lab and Fundación Capital which are helping the convergence of the private sector with the social sector. Also a special Global Treasury award was given to Malala Yousafzai, the 16 year old Pakistan who survived the Taliban attack and has set up the Malala Fund dedicated to helping promote education for girls around the globe.

Unilever and Ikea: all in for sustainability

We have seen a movement towards sustainability in different circles for the past 10 years. There is progress but you need many players including the big corporates. That is why it is so significant to see two great examples Unilever and Ikea going in fully for sustainability. Unilever’s COO Harish Manwani passionately argues in his TED talk, “Profit’s not always the point”, that the only way to run a 21st century business responsibly is by including value, purpose and sustainability in top-level decision-making. Steve Howard, the chief sustainability officer at IKEA is making the low-price-furniture giant to bring sustainable products to millions of people, as he puts it “Sustainability has gone from a nice-to-do to a must-do”. Watch the two positive and inspiring TED talks!

http://new.ted.com/talks/harish_manwani_profit_s_not_always_the_point

http://new.ted.com/talks/steve_howard_let_s_go_all_in_on_selling_sustainability

Update on impact investing

Some recent great reads

1) Willy Foote’s article on agricultural finance, How To Help 450 Million Poor Farmers–Without Destroying The Earth

2) WEF’s report on mainstreaming impact investments: From the Margins to the Mainstream

3) Morgan Stanley’s commitment to Investing with Impact platform, 5 year target 10bn USD of client assets

November was a month of conferences with TBLI, EVPA and Lugano Fund Forum. The first two are very much focused on impact but LFF is a more conventional Fund Forum for accredited investors and wealth managers in Ticino and Italy. It was therefore great to see that they incorporated a panel for Impact Investments where I had the opportunity to give a presentation introducing this topic “Managing Wealth for Impact and Profits“

Microrate’s report “The State of Microfinance Investments 2013”

Microrate’s “The State of Microfinance Investments 2013” is out. This 8th annual survey covers 92 active microfinance investment vehicles representing $8.1bn in assets under management. Key findings:

– total asset growth +17%, microfinance portfolio +18%.

-Liquidity declined to 8.2% of total assets, down from a high of 14.6% in 2009.

-Growth in all regions, with Latin America (24%) and East Asia/Pacific (23%) posting the strongest growth, and moderate growth in South Asia (12%), Africa (12%), and Europe/Central Asia (10%).

-Azerbaijan (45%), Georgia (78%), Mongolia (38%), and Bosnia (43%) were among the fastest-growing countries.

-Funds continue to mature, with investors redeeming $438 million in 2012.

-MIV sector continuing to deconsolidate, with largest MIVs continuing to lose market share. Similar trend among fund managers.

-Equity investment grew by $77 million, but declined as a share of the portfolio from 20% to 18%.

-Institutional investors continue to dominate, with 56% share of total investment.

(source Microrate)

Bunker Roy receives the prestigious Clinton Global Citizen Award

Last night Bunker Roy, founder of Barefoot College was one of the 7 recipients of the prestigious Clinton Global Citizen Awards. . The awards were presented at the Clinton Global Initiative Annual Meeting in New York,

..the honorees are chosen based on their innovative and effective approaches to making positive global change, and on their work’s potential for scalable growth and sustainability. They are leaders whose efforts transcend borders, change lives, and set an example for us all…

( source: Clinton Global Initiative)

Congratulations Bunker!

What’s new in Impact Investing

SOCAP 13 (Social Capital Markets, at the intersection of money and meaning) conference took place last week. I could not attend this year but it is great that the videos have already been made available on their website. A platform launched during this conference is ImpactSpace, an open data and resources platform. Their mission is to accelerate impact investing by making information available about the impact market (companies, investors, deals, people) to everyone and maintainable by anyone. It looks already a very helpful and promising resource.

Regarding recent articles and reports in this field that are highly recommended to read are;

1) “When can impact investing create real impact?” by Paul Brest and Kelly Born that appeared in the Stanford Social Innovation Review. The article and the responses by industry experts give a great insight on this topic.

2) “Making Impact Investible” by Max Martin of Impact Economy is a solid and rich working paper that provides a clear framework to understand the industry, all actors and also provides recommendations on how to scale up the industry.