I had the pleasure to meet recently Liam Foran, CEO and co-founder of the Peace Dividend Initiatives.

The Peace Dividend Initiative (PDI) is a peace-dividend accelerator dedicated to harnessing market forces for peace. PDI bridges the gap between peace mediation and economic actors through dialogue, incubation, and investment. Headquartered in Geneva, PDI is connected to peacemakers, international organizations, governments, investors, and entrepreneurs.

https://www.peacedividends.org/

So PDI has been cultivating peace-supporting economic opportunities in fragile and at-risk countries. In other words, incubating enterprises in places that have signed cease-fire agreements or in conflicts. What has been missing in these places are opportunities and funding to be able to kickstart economic activities/opportunities for the people. For example, ex-soldiers might go back to the militias/terrorists if they have no other alternative to earn a living. In Colombia, PDI has supported the incubation of a premium cacao company as well as a coffee company.

There are currently 40 countries in the World Bank’s “Fragile and Conflict affected Situations” list or in short the FCS list. There is a dire need for peace-making in the world so that all countries can continue to survive, thrive and prosper.

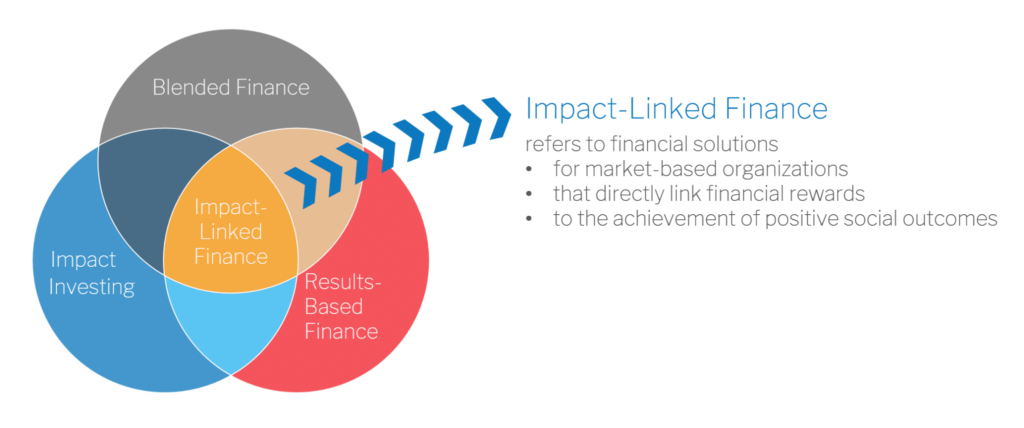

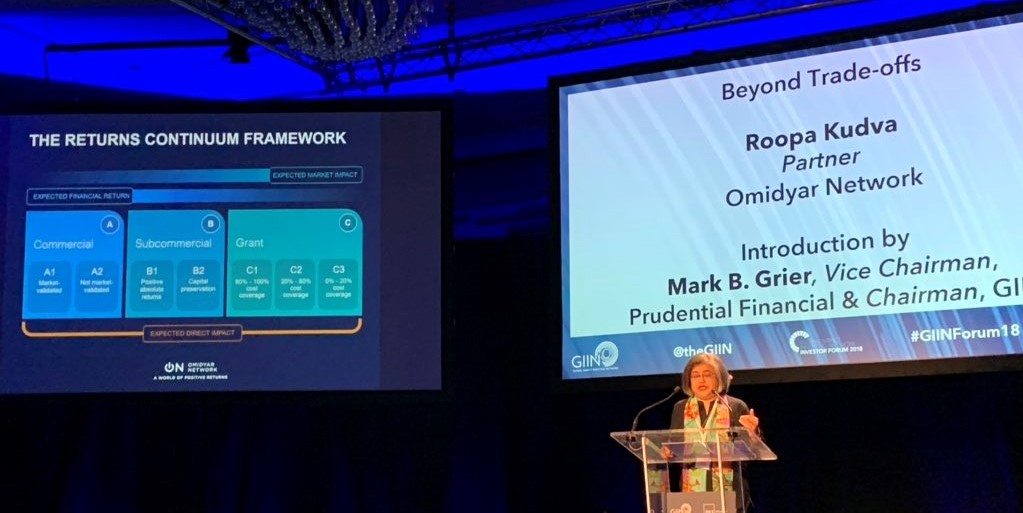

An exciting development is that PDI is joining forces with Symbiotics to launch a Peace Venture Fund. This can allow a blended finance opportunity for governments as well as private sector and philanhtropists to invest in achieving PEACE.